QR Codes and US Tax Documents

Financial Data Exchange (FDX) is a standard-setting organization best known for its work to unify the financial industry around common standards for open finance.

The FDX standards also apply to the annual delivery and consumption of US tax document data. When tax document (W-2, 1099, etc.) issuers and tax software applications adopt these standards, the process to prepare an individual income tax return is simplified and streamlined.

In this article, we will describe the FDX standard for delivering and consuming tax data using QR codes. In future articles, we will discuss (1) PDF with embedded data, (2) tax data extract files, and (3) secure FDX data servers.

QR Code Technology

QR (Quick Response) Codes are frequently used to hold an internet address. A smartphone user scans the code and the phone opens the referenced web page. But QR codes can hold text of any kind. FDX-standard QR codes do not hold an internet address. Instead, they directly hold the tax document data itself. Specifically, the tax data is encoded to match FDX’s standard JavaScript Object Notation (JSON) format. Then the QR code can be scanned by a tax smartphone app. The app reads the FDX tax data and imports it into the tax return of the app user.

Benefits to Taxpayers

This technology eliminates data entry errors in the income tax return preparation process and reduces time spent in tax preparation. So in this context QR can mean “Quicker Refund”.

Benefits to Tax Software Companies

For tax software companies the technology reduces programming costs associated with Optical Character Recognition (OCR) technology and increases the success rate of tax document scanning over OCR. It also provides a simple mechanism for tax document issuers and tax software to integrate without having to build out full system-to-system connections.

QR Code Placement

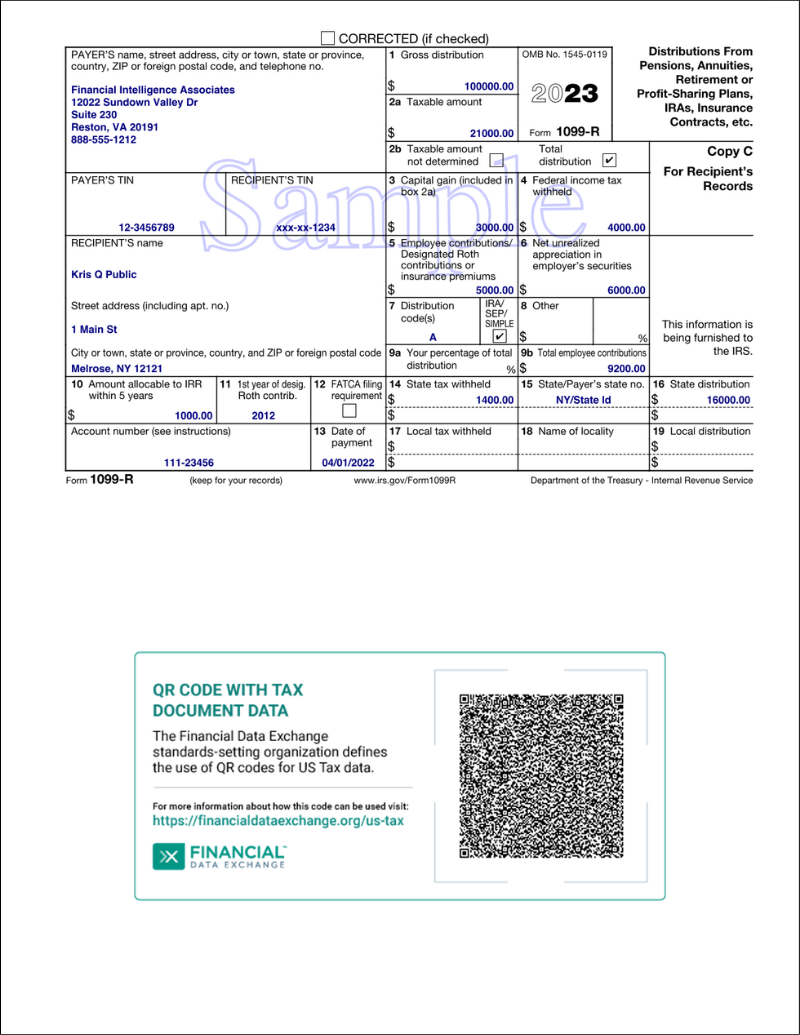

The program that generates a tax document can place the QR code on a cover sheet, a trailer sheet, or in available space below the tax form as seen in this example:

Using QR Codes for Larger Volumes of Data

There is a limit to the amount of data that a QR code can hold. For example, the data shown on a broker’s consolidated tax statement will not fit in a QR code. However, the tax document provider can host a data server allowing retrieval of tax data based on document credentials. Then those credentials can be placed in the QR code to allow a tax app to scan them, retrieve the tax data via the data server, and then import the data into the user’s tax return.

For more information

If you are interested in learning more, visit http://financialdataexchange.org/us-tax or contact [email protected].